Introduction

“GRC stands for Governance, Risk, and Compliance and is a concept that was originated by the Open Compliance and Ethics Group (OCEG) in 2002.” [1]

In today’s rapidly changing business environment, organisations face many challenges, such as increasingly complex regulatory requirements, increasing risks and the growing need for robust governance practices. To navigate these hurdles successfully, businesses should adopt an enterprise and comprehensive approach. Specifically, develop a GRC Framework.

A GRC framework comprises the three components defined by the OCEG above. It ensures they work together to aid organisations in adhering to legal and ethical standards, manage and mitigate risks effectively and make more informed decisions that align with their business objectives.

This blog post will explore the following points:

A brief explanation of the importance of GRC in business

Components of GRC

Integration of GRC components

Benefits of GRC

Conclusion

Let’s dive into the fascinating and essential world of GRC and its place in the modern business landscape.

A brief explanation of the importance of GRC in business

According to OCEG, GRC is the capability or integrated collection of tools that enables an organisation to achieve objectives reliably, address uncertainty, and act with integrity [1].

CIO explains GRC as follows:

“Think of GRC as a structured approach to aligning IT with business objectives, while effectively managing risk and meeting compliance requirements.”

A well-planned GRC strategy has many benefits, including:

- Improved decision-making

- More optimal IT investments

- Elimination of information silos

- Reduced fragmentation among divisions and departments

The main goal of GRC is to promote good business practices by synchronizing information and activities across governance, risk management, and compliance. This integration enables organizations to operate more efficiently.

Components of GRC

Governance:

Firstly, governance refers to guiding principles, policies, and procedures an organisation puts in place to direct and manage operations effectively. It encompasses the processes and structures that ensure accountability, transparency, and ethical behaviour in decision-making and management practices [2]. Good governance involves establishing principles of security, transparency, equity, compliance, reliance, and accountability [3].

Governance is an essential aspect of organisational management that helps ensure the long-term success and sustainability of the organisation.

Risk Management:

Secondly, Risk Management refers to the identification, plans for mitigation and implementation of mitigating controls of threats or risks to a business and the process used to achieve this.

The Risk and Insurance Management Society (RIMS) glossary defines risk as:

“[A]n uncertain future outcome that can either improve or worsen an organisation’s position; the effect of uncertainty on objectives (ISO 31000:2018).” [4][5]

RIMS define risk management as a management structure that aims to identify and plan control measures. Risk management is then implementing those mitigations to minimise or eliminate threats to the organisation’s position. The bylaws of the RIMS define risk management as the process and discipline of assessing risk to make more informed decisions [6].

All businesses rely on sound risk management, a legal requirement for many industries.

Compliance:

Finally, compliance involves adhering to laws, regulations, and internal policies that govern an organisation’s operations.

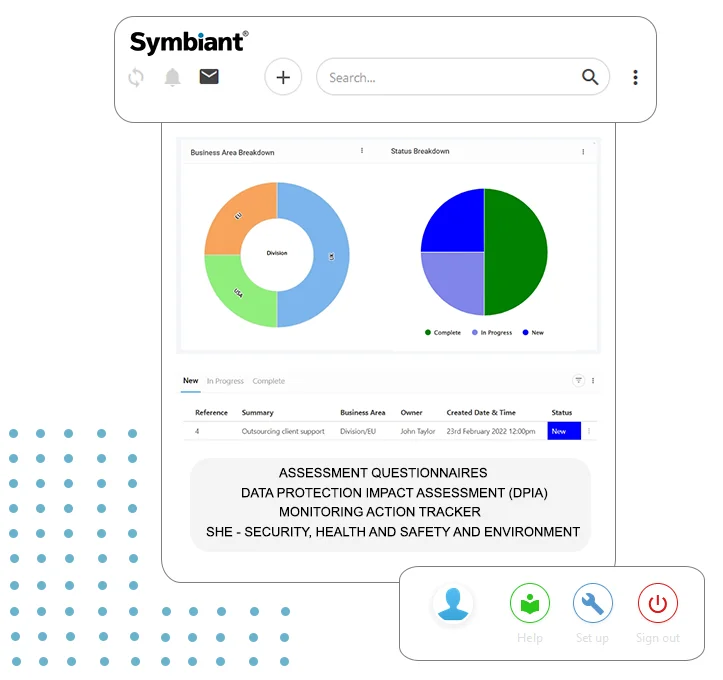

Compliance risk refers to an organisation’s potential exposure when it fails to comply with industry laws, regulations, internal policies, or best practices. It can lead to legal penalties, financial losses, and material consequences. Compliance risk management involves identifying, assessing, and mitigating potential losses from non-compliance with laws and regulations [7].

Developing a GRC discipline is crucial, particularly for large organisations with extensive governance, risk management, and compliance requirements. Such organisations often need dedicated programs to meet these requirements effectively [8].

Integration of GRC Components

Explanation of GRC as a set of processes and procedures

Organisations follow various GRC processes and procedures to manage their governance, risk management, and compliance activities. Some standard GRC processes and techniques include:

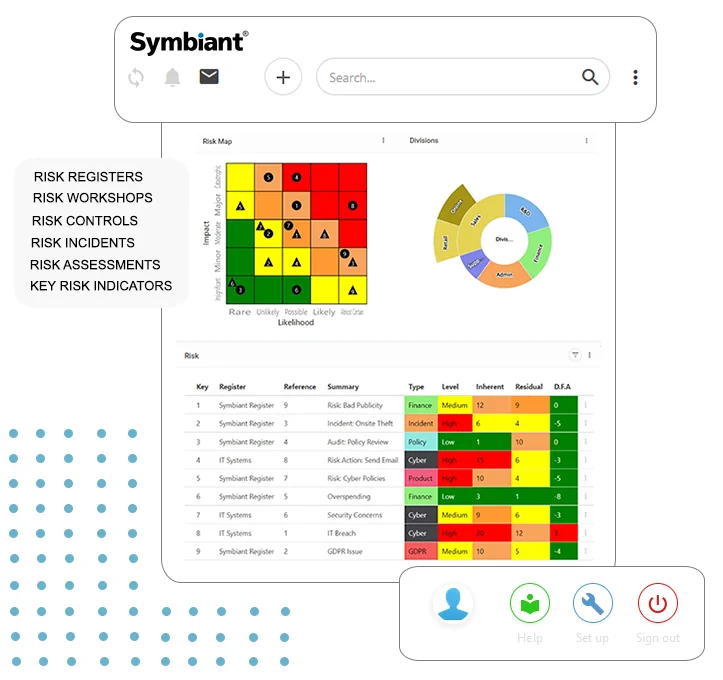

- Risk Assessment: a method used to identify potential threats (or risks) that could impact an organisation, whether these threats are internal or external. Risk Assessments involve looking at the various factors that can cause these threats that impact normal operations. For example, accidents, security breaches, and geopolitical threats. Risk assessments are the first step in controlling and mitigating those risks to limit or eliminate the impact of the dangers.

- Policy Management: involves developing policies and procedures to ensure compliance with regulations, laws, and internal policies. These policies help guarantee that the organisation can manage itself effectively and efficiently.

- Compliance Monitoring: organisations must monitor their compliance with regulations, laws and internal policies. This can be done by observing and reporting compliance activities, identifying any non-compliance areas and developing & implementing strategies to address them.

- Incident Management: creating and implementing procedures to allow organisations to respond to and deal with any incidents that may disrupt their usual operations. These incidents are often assessed during the risk assessment stage. Incident management is the implementation of the controls and mitigations previously. Strong incident management is essential in limiting or negating the effects of incidents.

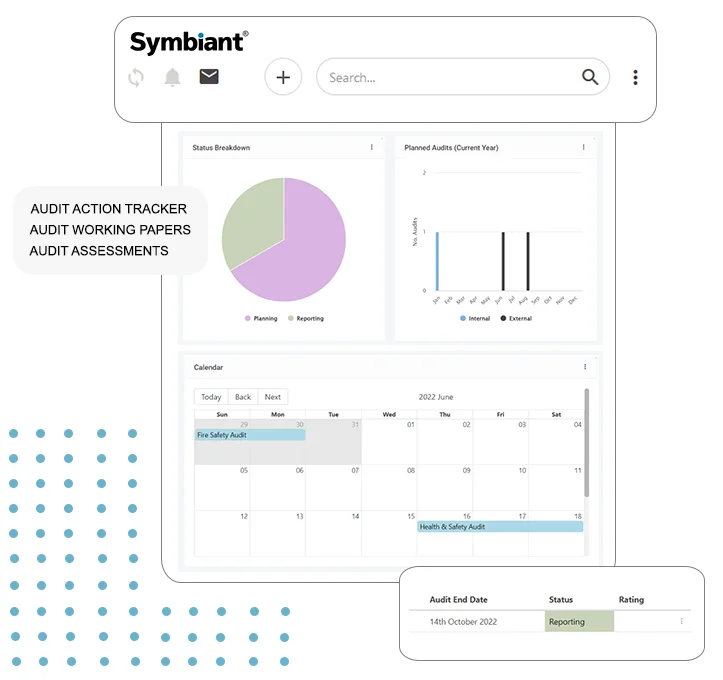

- Auditing: is a process in which organisations evaluate the internal and external operations and procedures to ensure compliance and best practise. Internal audits are completed by the organisation’s personnel, while independent entities carry out external audits. Audits involve thoroughly examining records, procedures, and practices to identify gaps, errors, or areas of non-compliance and then suggesting changes to resolve any of the issues brought up by the audit.

How governance, risk management, and compliance work together

The three components of GRC are integrated and independent of each other. Ideally, they work together cohesively to ensure that organisations operate responsibly and compliantly.

As discussed, governance sets the foundation of the GRC framework by defining roles and responsibilities, creating policies and procedures, and setting objectives. Governance is the basis, as this is the stage where businesses establish the structure for decision-making, accountability, and oversight. Governance ensures clear direction and alignment with the organisation’s mission and values.

Risk management comes next by identifying, assessing, and mitigating potential risks. Having a strong and creative risk strategy is essential to predict risks and either avoid them or minimise their impact if they were to occur. This component ensures organisations are aligned with their mission and values by proactively identifying and addressing potential risks which could hinder their objectives.

Compliance ties in by ensuring the organisation adheres to laws, regulations, and industry standards. Compliance involves understanding and implementing the necessary controls and policies to meet compliance requirements. These component activities include auditing, record maintenance and adherence reporting. Compliance ensures that organisations align with their mission and values while meeting legal and regulatory requirements. Compliance is implementing the risk management component; risk assessments mean nothing if a business implements them and then ensures compliance.

Overall, the overarching goal of GRC is to ensure that organisations’ activities align with their missions and values and comply with regulatory requirements. While all three can work independently and a certain degree of separation can be beneficial – having all three components working together to form an integrated GRC framework allow organisations to make more informed decisions and maintain a company culture of accountability and integrity.

Benefits of GRC

Improved decision-making

There are a variety of benefits GRC can provide; improved decision-making is one of them. Several elements of GRC lead to enhanced decision-making, such as:

- Integrated View: GRC can provide an integrated view of how well an organisation manages its risks. An integrated idea enables decision-makers to fully understand the risks associated with their decisions and then make more informed decisions based on that information [9].

- Risk-Aware Decisions: Creating effective GRC establishes processes and systems that enable every level to make risk-aware decisions. By having a single united database with real-time and high-quality data, stakeholders and managers can share knowledge and collaborate on actions, making risk-aware choices easier.

- Compliance: We’ve discussed compliance several times, but it is essential to any business. Ensuring your organisation is acting ethically and per its risk appetite is the primary goal of the compliance arm of GRC – it allows decision-makers to feel confident that their decisions comply with the applicable laws, regulations, and internal policies.

- Minimising Risks: Using GRC Software can minimise risks and ensure business compliance by providing precise and unalterable authorship of changes, connecting risks to incidents and controls, and providing near-instant reports, allowing auditors or GRC managers to focus on growth rather than compiling data for reporting. GRC software can give your decision-makers the confidence that the data they are looking for is up-to-date and that the risks associated with those decisions have been appropriately identified and mitigated.

- Comprehensive GRC Program: There are countless GRC programs available, but the primary goal is to aid decision-makers in identifying and evaluating risks, establishing procedures to ensure compliance, implementing controls and policies to reduce risks, and providing auditing is completed efficiently and effectively. A fully integrated software platform gives decision-makers a more structured, transparent approach that compiles all relevant risks and compliance requirements.

What is an information silo?

Finally, an information silo refers to information management systems (IMS) that do not allow accessible communication with other IMS. These systems often only provide information vertically – allowing higher-ups to access the data but not horizontally – to other IMS managers. A lack of communication and information sharing occurs when individuals store information vertically and do not believe it to be helpful to others [10].

Information silos pose a significant threat to your business, particularly considering the constantly evolving risk landscape in which modern companies operate. Decision-makers can create information silos when they fail to see the benefit of sharing or integrating their data systems within the organisation. These can result in less-informed decisions and a potential lack of compliance if decisions are made with outdated information.

Eliminating information silos can seem daunting, involving sweeping organisational changes. Still, achieving efficient communication, collaboration, and transparency within the organisation is necessary.

Conclusion

In conclusion, GRC is a critical framework for modern organisations to manoeuvre in an increasingly complex environment. Throughout this post, we have discussed the definition of GRC and delved into each component and how they interlink. By embracing GRC, organisations can better navigate challenges, make better-informed decisions, and establish a company culture of integrity and accountability.

GRC practices can help eliminate information silos and allow transparency in information across your organisation. By integrating GRC practices, businesses can identify risks promptly and implement appropriate mitigation strategies, safeguarding their operations and reputation. Additionally, GRC helps organisations maintain compliance with regulatory requirements, reducing legal and financial risks.

Overall, embracing GRC principles offers numerous benefits, including informed decision-making, improved operational efficiency, and increased stakeholder trust. As businesses navigate an ever-evolving landscape of risks and regulations, GRC remains a crucial framework for success.

A software solution such as Symbiant is designed to embed and facilitate GRC effectively & painlessly, and with prices starting at only £300 per month, you might find it’s less expensive than using inadequate tools such as spreadsheets.