Introduction

The Third Line of Defence (3LoD) model ensures effective internal auditing and risk management. Therefore, effective risk management is necessary and a strategic advantage for organisations in today’s complex business environment. Indeed, it is key to safeguarding assets, reputation, and long-term viability. To this end, the Three Lines of Defence (3LoD) model is a powerful tool that ensures a structured and comprehensive approach to risk management. This leads to enhanced control and a clear structure for effective risk management.

Furthermore, the 3LoD model is not just a theoretical concept but a practical and powerful tool that delineates organisational responsibilities and roles. It enhances risk management and control, providing a clear structure for how different functions interact and collaborate to manage risk effectively. Each ‘line’ in the model represents a specific layer of defence against potential risks, ensuring no overlap or confusion in responsibilities, making it a highly practical and effective framework.

“Companies with advanced risk management capabilities grow their earnings by 3% annually.”

Overview of the Three Lines of Defence Model

First Line of Defence: Operational Management

The First Line of Defence in the 3LoD model comprises the operational management and staff responsible for owning and managing risks in their daily activities. Specifically, these individuals and teams are directly involved in the organisation’s day-to-day operations. Their primary role is to identify, assess, control, and mitigate risks within their areas of responsibility.

Second Line of Defence: Risk Management and Compliance

The Second Line of Defence consists of functions that provide oversight, guidance, and support to the operational management (First Line of Defence). This line is essential in establishing the framework and ensuring the effectiveness of risk management practices across the organisation. Key roles within this line typically include risk management, compliance, and control functions.

You can read a more in-depth overview of the second line of defence in our blog post here.

Third Line of Defence: Internal Audit

The Third Line of Defence is represented by the internal audit function. This function provides independent and objective assurance of the effectiveness of an organisation’s governance, risk management, and internal controls. Unlike the first and second lines, which are directly involved in managing and overseeing risks, the third line operates independently and is an unbiased evaluator of the entire risk management framework.

The Role of the Third Line of Defence

How Internal Audit Provides an Unbiased Evaluation

- Autonomy in Planning and Execution: Internal auditors can determine the scope and nature of audits based on their professional judgment and risk assessments. Consequently, this autonomy ensures they can focus on areas of significant risk without influence from operational management.

- Professional Standards: Internal audit functions adhere to established professional standards and ethical guidelines, such as those set by the Institute of Internal Auditors (IIA). These standards mandate independence and objectivity in the audit process.

- Rotation and Fresh Perspectives: Additionally, regular rotation of audit assignments and including fresh perspectives help prevent familiarity threats and maintain internal auditors’ objectivity.

Types of Audits Conducted

- Financial Audits: Assess the accuracy and integrity of financial statements, ensuring compliance with accounting standards and financial reporting regulations.

- Operational Audits: Evaluate the efficiency and effectiveness of operational processes, identifying opportunities for improvement and cost savings.

- Compliance Audits: Ensure the organisation adheres to applicable laws, regulations, policies, and procedures, including audits focused on regulatory compliance, ethical standards, and internal policies.

- IT Audits: Assess the organisation’s information systems’ security, integrity, and reliability, including evaluating cybersecurity measures, data protection practices, and IT governance.

- Environmental and Social Audits: Evaluate the organisation’s adherence to environmental regulations and social responsibility commitments.

Benefits of an Effective Third Line of Defence

- Comprehensive Risk Assessments: Internal audits can support thorough risk assessments, identifying potential and emerging risks that might not be visible to operational management. Consequently, this proactive approach helps organisations anticipate and prepare for risks before they materialise.

- Holistic View of Risk: By evaluating risk management practices across the organisation, internal audit provides a holistic view of risk, ensuring that all significant risks are identified and addressed. Therefore, this comprehensive perspective supports more effective risk mitigation strategies.

- Continuous Monitoring: Internal auditors continually monitor risk exposures and the effectiveness of controls. This ongoing vigilance helps detect and mitigate risks in real time, reducing the likelihood of significant issues.

- Control Testing and Validation: Internal auditors rigorously test and validate the effectiveness of internal controls. This ensures that controls are not only designed appropriately but are also operating as intended.

- Regulatory Compliance Audits: Internal auditors can explicitly focus on regulatory compliance, ensuring that the organisation adheres to applicable laws, regulations, and industry standards. These audits include evaluating compliance with financial regulations, data protection laws, and environmental standards.

- Cost Savings: Through operational audits, internal audits identify cost savings and resource optimisation opportunities. Recommendations often include streamlining workflows, reducing redundant activities, or leveraging technology for automation.

Challenges and Considerations

- Importance of Collaboration: While maintaining independence is crucial for the internal audit function, collaboration with other lines of defence and operational management is essential for gaining insights and understanding the context of business processes.

- Transparent Communication: Foster open and transparent communication channels with management. Regular meetings help align expectations and facilitate information sharing without compromising audit independence.

- Separate Reporting Lines: Maintain separate reporting lines for internal audit to the audit committee or board of directors, ensuring that management pressures do not influence auditors.

- Dynamic Risk Environment: The risk landscape continuously evolves due to technological advancements, regulatory changes, and market dynamics. Internal auditors must stay ahead of these changes to provide relevant and effective assurance.

Conclusion

The Three Lines of Defence (3LoD) model represents a fundamental framework for robust risk management within organisations. Each line is critical in safeguarding against risks and ensuring effective governance. The Third Line of Defence, represented by the internal audit function, stands out as a cornerstone of independent assurance and oversight.

Furthermore, as the Third Line of Defence, the internal audit function provides independent and objective assurance to the organisation’s stakeholders. These stakeholders can include the board of directors and senior management. By conducting comprehensive audits and assessments, internal auditors evaluate the effectiveness of governance processes, risk management practices, and internal controls. This critical role enhances confidence in the organisation’s ability to manage risks effectively and achieve its objectives.

Moreover, internal audit’s role in identifying emerging risks, validating the effectiveness of controls, and ensuring regulatory compliance is a delicate balance. Through their impartial evaluations, internal auditors help mitigate risks and improve operational efficiencies. Thus fostering a culture of accountability and continuous improvement within the organisation. This underscores their power and responsibility in shaping the organisation’s risk management and operational efficiency.

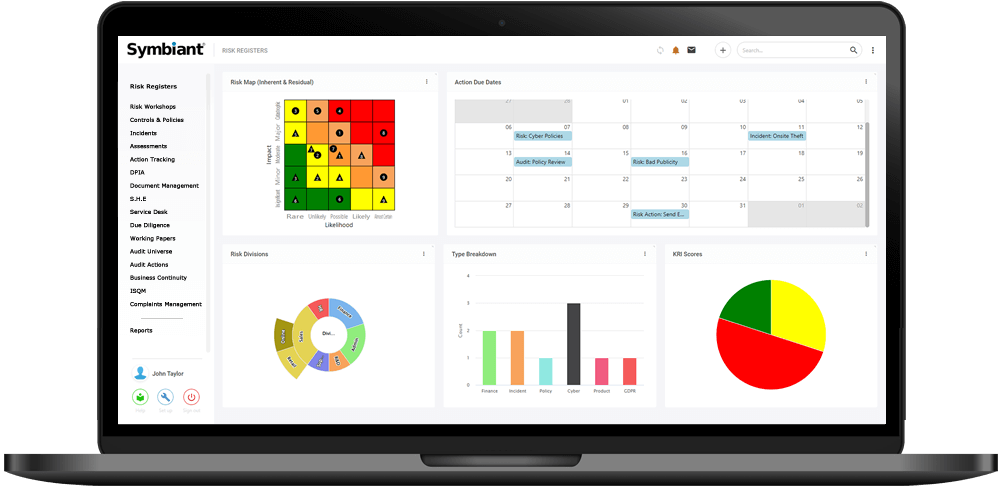

Additionally, supporting your internal auditors is becoming increasingly complicated, and having a holistic overview of your organisation’s risks for your auditors to utilise is impossible with Excel Spreadsheets. Symbiant aims to make supporting your auditors easy – book a free demo and discover the power and flexibility of Symbiant One at an unbeatable price.